Respect

We always respect all individuals and organisation we deal with and value their ideas and contributions.

Integrity

We are professional and honest in our working relationships. We strive for equity and fairness in our decision making and in our treatment of one another

Passion

Passion is at the heart of our company. We show enthusiasm and commitment in everything that we do.

Trust

We believe in trust and to be trusted as trust is the most important part of a healthy relationship.

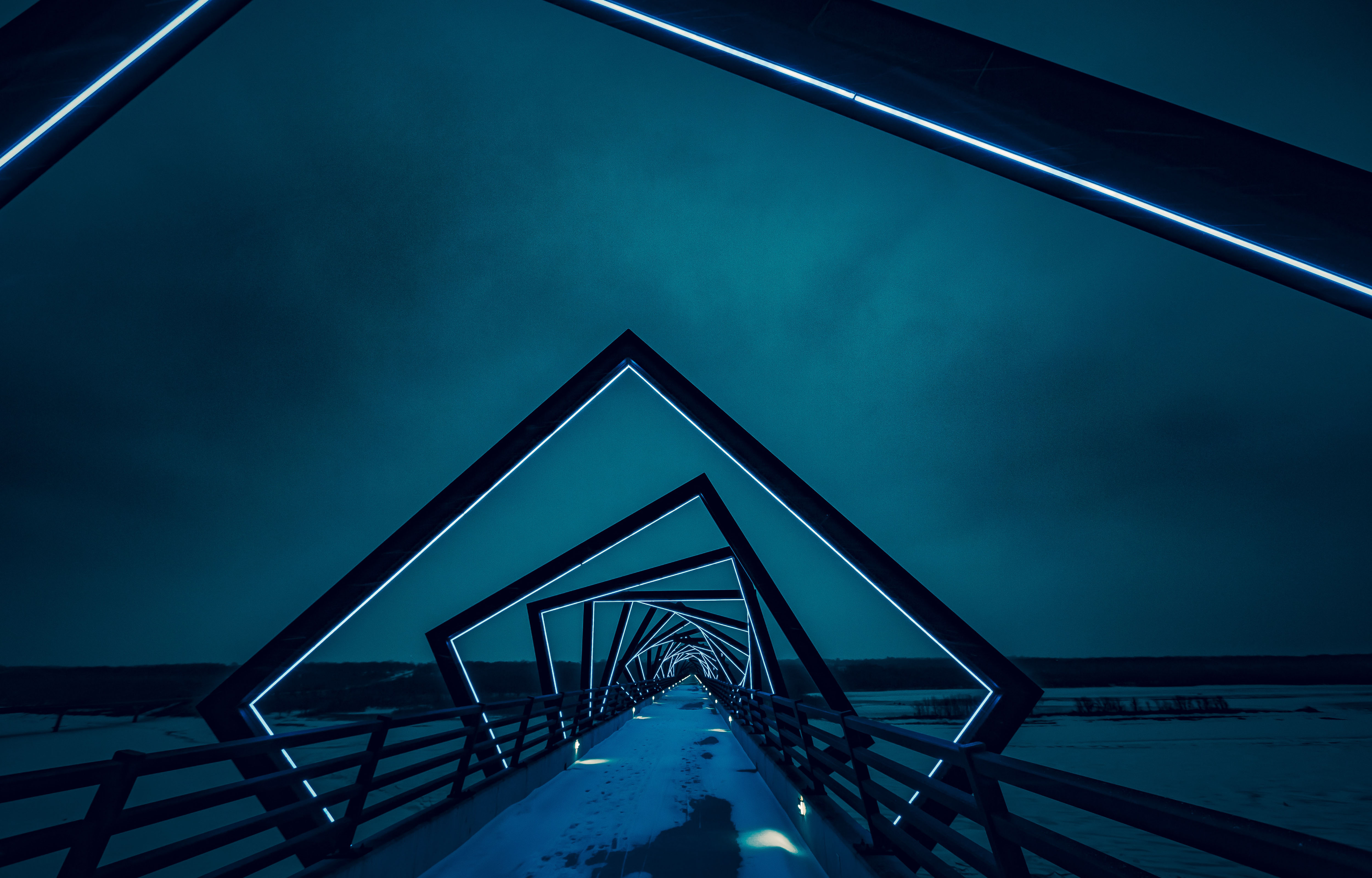

Excellence

We love what we do, and with our energy and drive we consistently reach seemingly impossible heights.